AUD/USD falls to a low of 0.7260

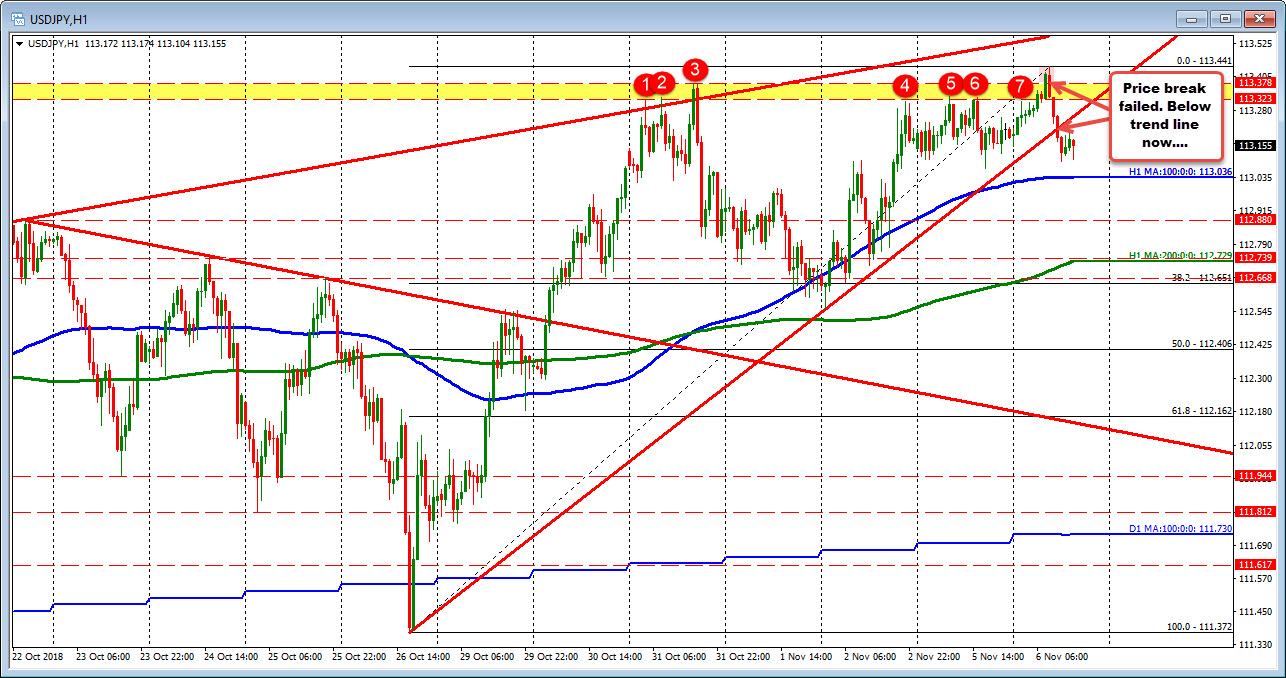

Price is now looking for a firm break below the 100-hour MA (red line) and the 38.2 retracement level @ 0.7272 and if sellers can hold a break there, the near-term bullish bias will be eliminated. The next key support level to eye for will then be the 200-hour MA (blue line) @ 0.7252 and the swing region support around 0.7250 which coincides with the 50.0 retracement level as well.

This comes as the dollar is strengthening back across the board and we're also seeing RBA's Lowe expressing worries with regards to the housing market and credit earlier.

Fall back below the 200-hour MA and near-term price bias turns more bearish. That will help to reinvigorate sellers to extend a move back to the downside particularly when risk assets are not faring all too well on the day.

via : forexlive